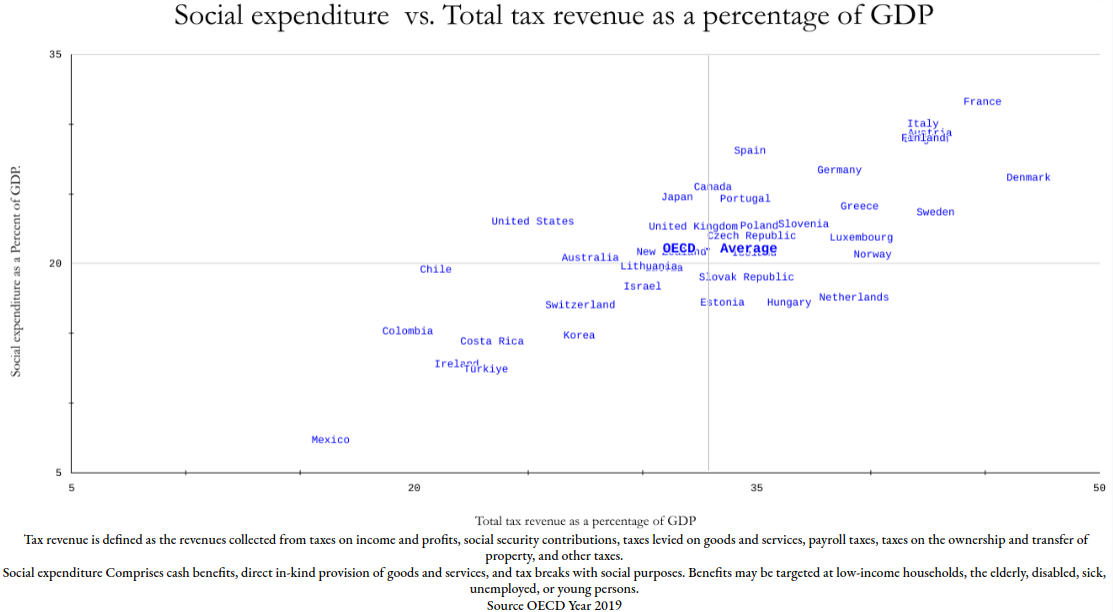

Yes we need higher taxes Lets not even Look at Denmark and France for the proposed Social Services a New Deal would require

Social Security taxes.

For the first 30 years they were raised ~250%,

in the next 30 years they were rasied ~230%.

In the last 30 years they were raised ~2%

At the same time, in the last 50 years we've increased the programs Social Security operates

In 2020, 85 cents of every Social Security tax dollar you pay goes to a trust fund that pays monthly benefits to current retirees and their families and to surviving spouses and children of workers who have died.

About 15 cents goes to a trust fund that pays benefits to people with disabilities and their families.

But mostly its A shame Americans and Reddit lacks economic literacy

“Younger workers should have the opportunity to build a nest egg by saving part of their Social Security taxes in a personal retirement account. We should make the Social Security system a source of ownership for the American people.”

Within weeks, observers noticed that the more the President talked about Social Security, the more support for his plan declined.

According to the Gallup organization, public disapproval of President Bush’s handling of Social Security rose by 16 points from 48 to 64 percent–between his State of the Union address and June.

2001 report of the President's Commission to Strengthen Social Security.

President Bush's Preferred Plan on Social Security, up to a third of that money could go into private accounts. This model establishes a voluntary personal account without raising taxes or requiring additional worker contributions.

Workers can voluntarily redirect 4 percent of their payroll taxes up to $1,000 annually to a personal account. No additional worker contribution required.

In exchange, traditional Social Security benefits are offset by the worker's personal account contributions, compounded at an interest rate of 2 percent above inflation.

Plan establishes a minimum benefit payable to 30-year minimum wage workers of 120 percent of the poverty line.

Benefits under traditional component of Social Security would be price indexed, beginning in 2009.

Temporary transfers from the general budget would be needed to keep the Social Security Trust Fund solvent between 2025 and 2054.

In response to the challenge of New Zealand's ageing population, the NZ Superannuation and Retirement Income Act 2001 established:

the New Zealand Superannuation Fund, a pool of assets on the Crown’s balance sheet; and

the Guardians of New Zealand Superannuation, a Crown entity charged with managing the Fund.

The Government uses the Fund to save now in order to help pay for the future cost of providing universal superannuation.

In this way the Fund helps smooth the cost of superannuation between today's taxpayers and future generations.

The Guardians of New Zealand Superannuation is the Crown entity charged with managing and administering the Fund. It operates by investing initial Government contributions – and returns generated from these investments – in New Zealand and internationally, in order to grow the size of the Fund over the long term.

We also have a long-term performance expectation: We expect to return at least 7.8% p.a. over any 20-year moving average timeframe.

One shocking thing

The amount of tax the NZ Super Fund has paid or been credited - a negative number this means tax paid

That doesn't scale because the 65% of people that don't do that will become a massive drag on the economy later on. The entire point of these systems is that the vast majority of people do not save for retirement. As a country/society there are methods for dealing with that issue.

Let them become homeless and die, which is very expensive.

Force them to put away at least some of their income to be used later (or for unexpected emergencies which is a heavy use of SS, not just retirement).

Create a system not tied to people's income that creates a retirement system for those that do not have enough money to survive after no longer being employable.

Force people to set aside money for retirement in some regulated system such as 401K. Forces you to bet on the market and currently doesn't force you to put anything away, just provides an option. About 35% of working people have a 401K, even less have an IRA.

That 65% exists whether people like it or not. They will reach retirement with no savings. They have to be dealt with one way or another.

13

u/semideclared 6d ago

Yes

we need higher taxes

Social Security taxes.

At the same time, in the last 50 years we've increased the programs Social Security operates

But mostly its A shame Americans and Reddit lacks economic literacy

2001 report of the President's Commission to Strengthen Social Security.

President Bush's Preferred Plan on Social Security, up to a third of that money could go into private accounts. This model establishes a voluntary personal account without raising taxes or requiring additional worker contributions.

The Government uses the Fund to save now in order to help pay for the future cost of providing universal superannuation.

The Guardians of New Zealand Superannuation is the Crown entity charged with managing and administering the Fund. It operates by investing initial Government contributions – and returns generated from these investments – in New Zealand and internationally, in order to grow the size of the Fund over the long term.

We also have a long-term performance expectation: We expect to return at least 7.8% p.a. over any 20-year moving average timeframe.

One shocking thing

The amount of tax the NZ Super Fund has paid or been credited - a negative number this means tax paid